excise tax ma pay

To avoid not receiving an excise tax bill on time or at all please keep the Registry your local Tax Assessor and the Post Office aware of your current mailing addressFor more information on. Weymouth Tax Rate History.

Massachusetts Enacts Pte Elective Excise As Workaround To 10k Salt Cap Tonneson Co

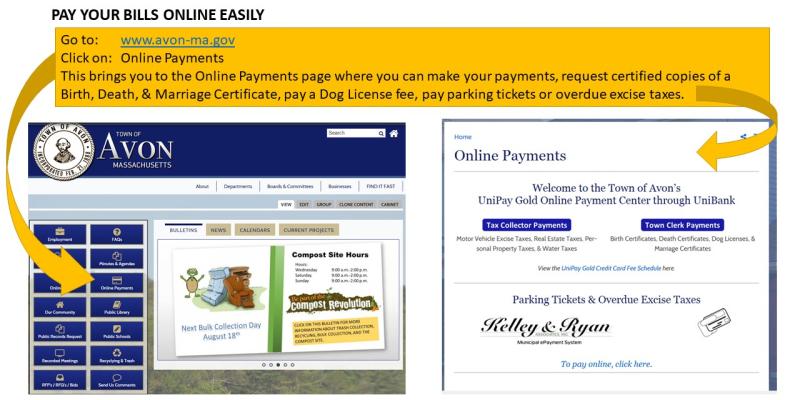

Parking Ticket Payment Link.

. If you have problems completing an online tax payment please use our online Tax Help form to request assistance. If you dont make your payment within 30 days of the date the City issued the excise. After 30 days a.

If you are unable to find your bill try searching by bill type. All corporations that expect to pay more than 1000 for the corporate excise tax have to make estimated tax payments to Massachusetts. You can pay online by mail or at the Registry of Motor Vehicles.

It needs to pay. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. The current excise tax rate for motor vehicles is 25 per 1000 of your vehicles value.

Box 397 Reading MA 01867. Drivers License Number Do not enter vehicle plate numbers. A vehicles excise valuation is based on the manufacturers list price MSRP in the vehicles year of manufacture.

To check for additional past due bills you can click on the Excise Tax Delinquent link below or call the Collectors Office at 978-619-5621. Various percentages of the manufacturers list price are applied as. -You are unable to locate your bill using the.

Important information Regarding Your Property Tax. Water Sewer Bill. Pay View Taxes.

Your browser appears to have cookies disabled. Pay CURRENT FISCAL YEAR Springfield Taxes and Fees. Pay your Parking Tickets here.

Bills that are more than 45 days past due are marked at the registry for non-renewal sent to the Deputy Collector. Association Official Used Car Guide NADA. If you want to pay your.

Business Income and Excise Taxes. If the excise remains unpaid at anytime after the FinalService of Warrant. Online Bill Payment Center.

Clicking the payment of choice will display the available options and any associated service fees. Deputy Collector of Taxes PO. Excise bills must show the date upon which the bills were issued and must contain the statement Due and Payable in Full Within 30 Days of Issue.

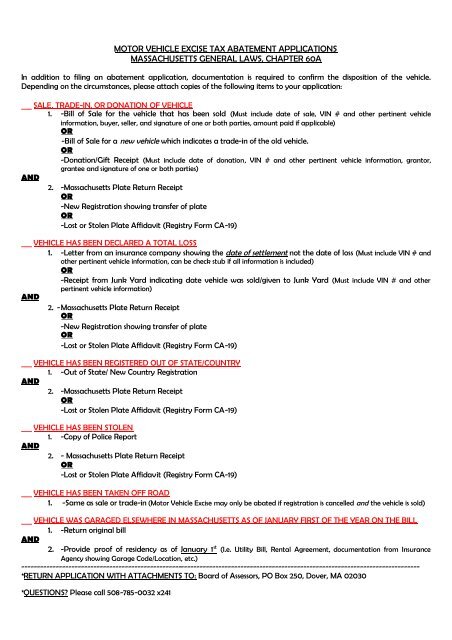

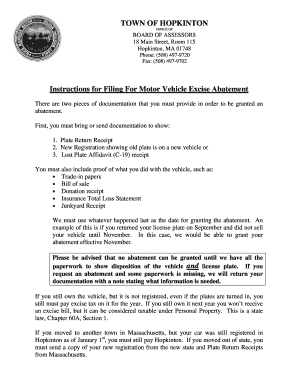

Payments are due 30 days from the date of issue of the bill. New York State PTET Addback Effective for 2021. General Overview Massachusetts General Law Under Massachusetts General Law MGL 60A all residents who own a motor vehicle must pay an annual excise taxThe tax is generated by the.

Cookies are required to use this site. For tax years beginning on or after January 1 2021 General Corporation Tax. Available payment options vary among services and our online payment partners.

Payment of tax or. Present market value price paid or condition are not considered for excise tax purposes. The Town mails motor vehicle excise bills to registered owners once a year or after a change in registration.

Excise tax demand bills are due 14 days from the date of issue. The Town of Tewksbury offers residents an easy and secure way to view print and pay their Real Estate Tax Personal Property Tax Vehicle Excise Tax and Water and Sewer bills online. Find your bill using your license number and date of birth.

Motor Vehicle Excise Tax Abatement Applications Massachusetts

2012 Massachusetts Corporate Excise Tax Forms And Instructions Fill Out Sign Online Dochub

Massachusetts State Tax Information Support

Do You Report Paid Excise Tax In Massachusetts

Hopkinton Town Ma Tax Collector Fill Online Printable Fillable Blank Pdffiller

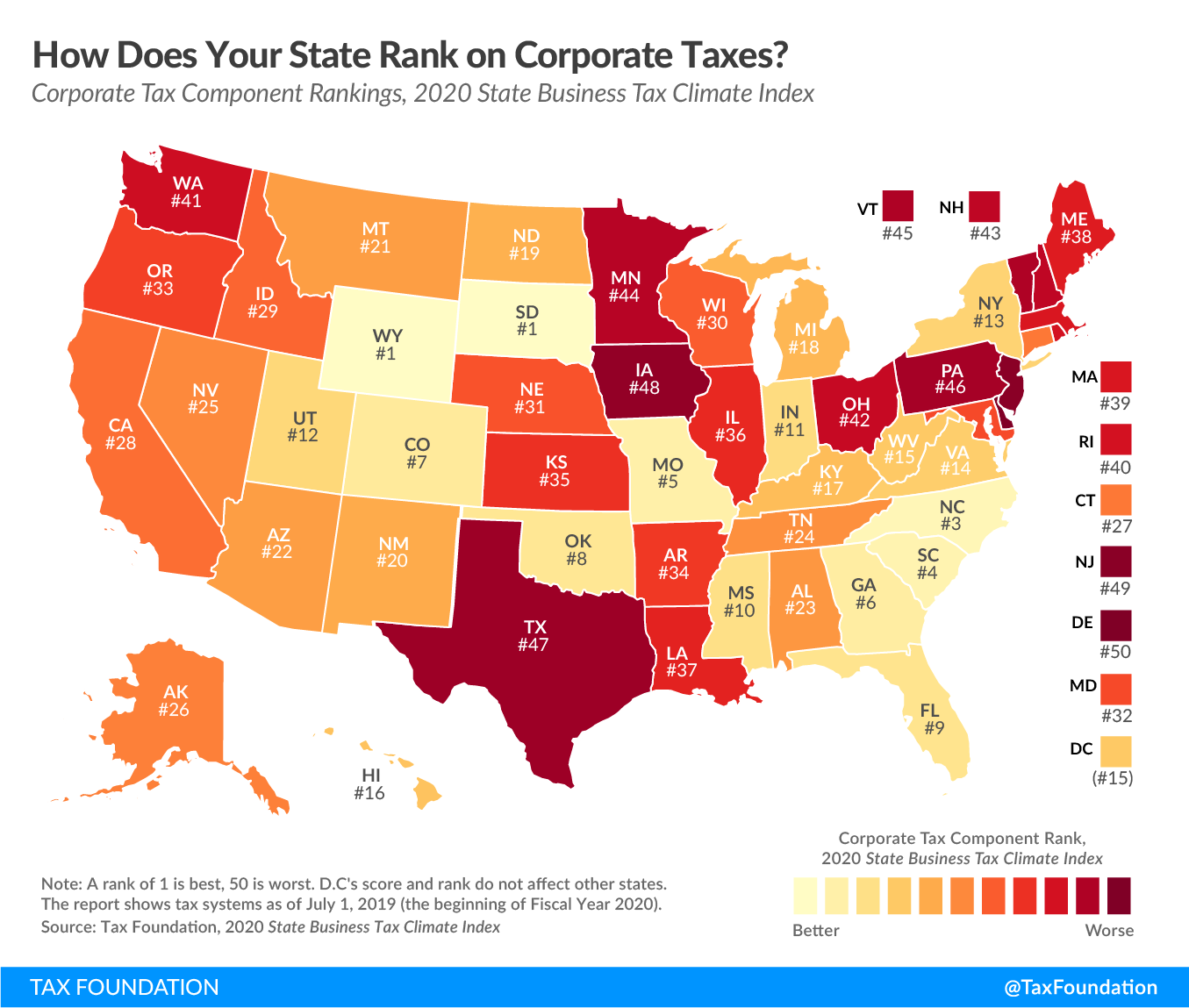

Massachusetts Corporate Excise Tax Should Be More Competitive

Ma Business Taxes How Our State Compares To The Nation Massbudget

Online Bill Payment Acton Ma Official Website

Online Payments Watertown Ma Official Website

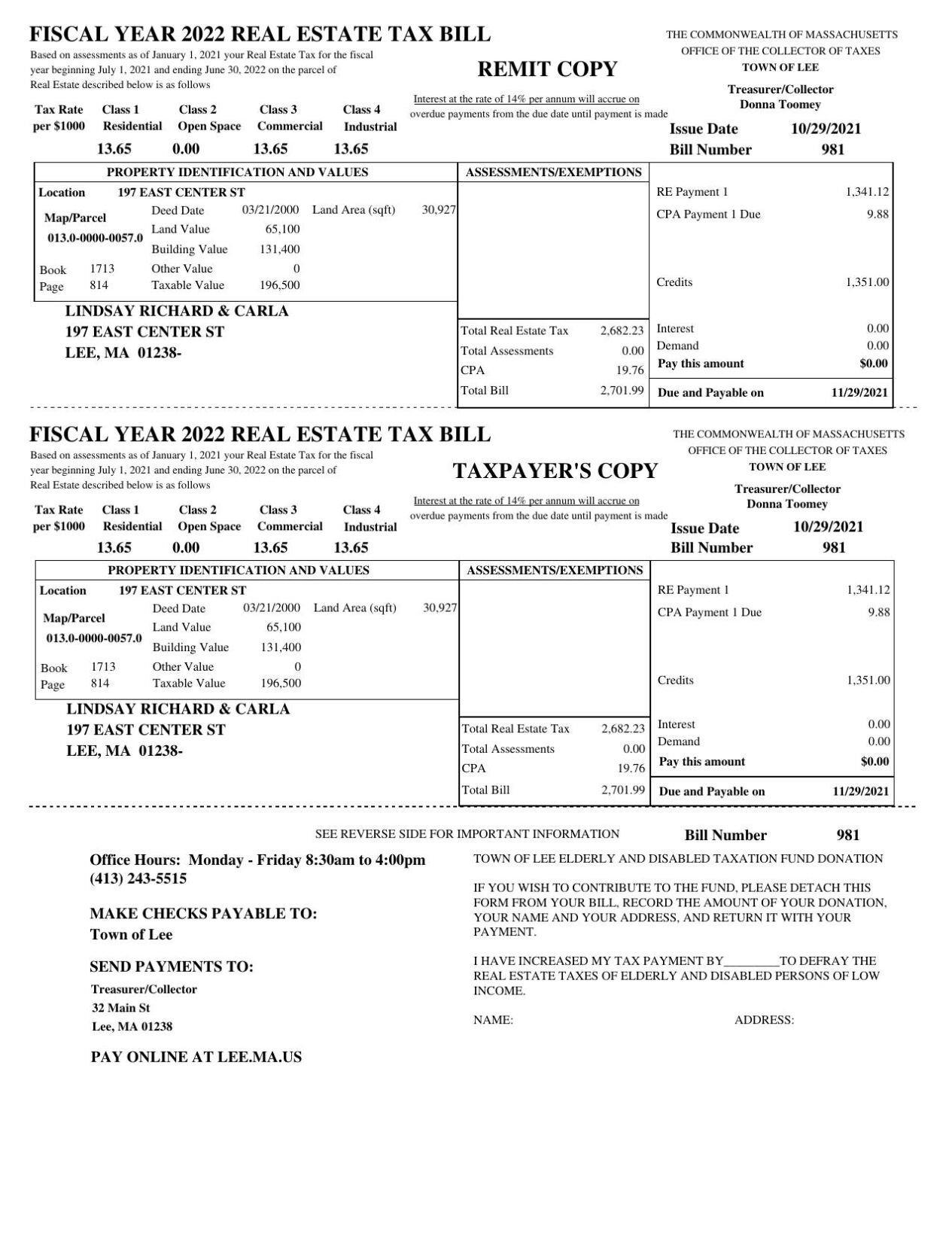

6 Things To Know About Your Property Tax Bill If You Own A Home In Berkshire County Local News Berkshireeagle Com

Beer Excise Sales And Meals Tax 101 Massachusetts Brewers Guild

Excise Tax Gloucester Ma Official Website

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Baker Wants To Hike Excise Tax To Fight Climate Change Others Say It Should Help Housing Crisis Wbur News